Reduce Fraud Liability

-

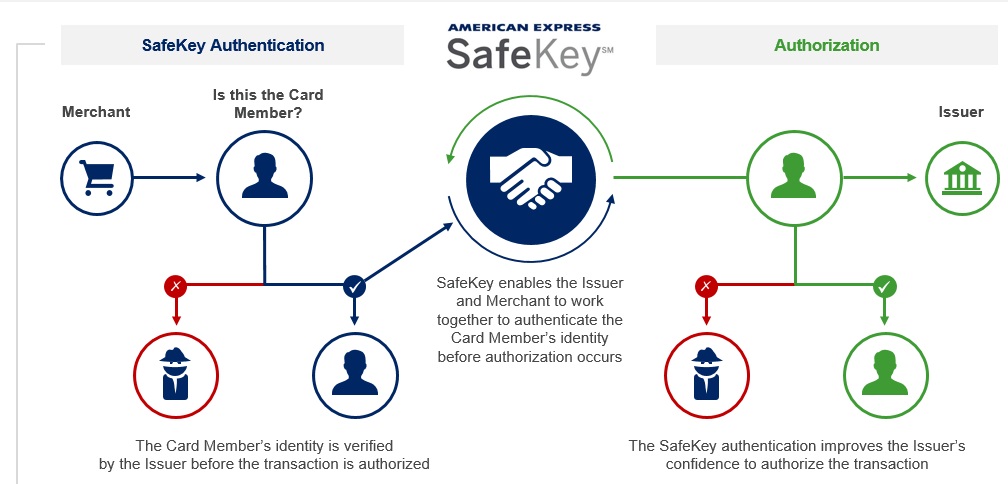

Transfers liability for fraud chargebacks on SafeKey authenticated and attempted transactions to the Issuer

-

Works alongside other tools to manage fraud

Increase Profitability

-

Helps customers feel more secure about online purchases potentially increasing their confidence to spend

Reduce Shopping Cart Abandonment

-

Allows Issuers to use additional data elements already part of the checkout process to authenticate a Card Member without a ‘challenge’* reducing friction, leading to a higher conversion of sales

*A ‘challenge’ is when an Issuer can request the Card Member to prove his/her identity, e.g. by use of a One-Time Passcode (OTP).