American Express Contactless Payments

A touch-free payment solution that enables Cardmembers to conveniently tap and pay with their Card or mobile device

Overview

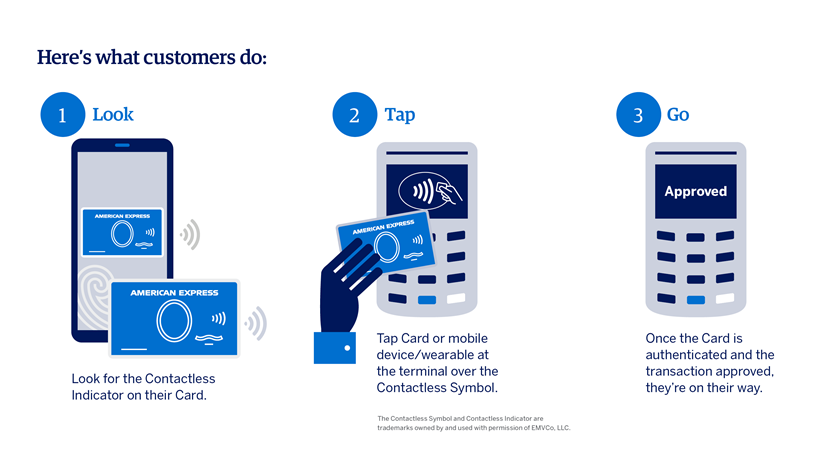

Contactless payments not only provide a faster way to pay, but they help keep the checkout process cleaner by reducing exposure to health risks for both customers and employees. Cardmembers can simply tap their contactless Card or device on a contactless-enabled terminal—for a quick, touch-free payment experience.

Contactless chip payments use radio frequency technology to perform transactions, and with a simple tap, the Card and reader exchange secure payment information. Contactless-enabled chips have been utilized in various form factors such as cards, key fobs, and wearables.

Benefits

Contactless payments provide Card Issuers and Merchants with the following benefits:

Touch-Free:

- With a contactless transaction, there’s no need to touch the terminal and less time is spent between customer and cashier

Secure:

- Protected by proven encryption, contactless payments are as secure as chip technology

Grow revenue:

- Help grow your business by offering an expanded suite of products to Cardmembers and Merchants.

- Help gain incremental revenue by promoting a technology that encourages Card spending over cash.

Drive top-of-wallet preference:

- Enable consumer-preferred forms of payment.

- Help ensure a secure and protected shopping experience to gain Cardmember trust and confidence.

- Understand customer purchasing behavior for Cardmembers who opt-in to share their information in order to provide relevant follow-up offers and ensure customer loyalty beyond the point of sale.